Information about starting a Dutch BV in The Netherlands

BV

Setting up a BV

The Dutch BV (Besloten Vennootschap) or the limited liability company (Besloten Vennootschap met beperkte aansprakelijkheid) is the most employed type of company in the Netherlands. The Dutch BV is the equivalent of the German GmbH and the American limited liability company. Considering the new amendments brought to the Company Law, the incorporation procedure for a Dutch BV has been simplified and the costs related to company formation in Holland have been reduced. The BV is also the most employed type of structure when setting up a holding company in the Netherlands.

Requirements for opening a Dutch BV

The Dutch BV may have one or more founders who can be individuals or companies. The new Company Law in the Netherland allows the limited liability company to have one shareholder who can also act as manager. One of the advantages of the Dutch limited liability company is that it requires no minimum share capital. The Company Act only required the founder to issue one share with a voting right. The only requirement for the BV is to have a registered address in the Netherlands.

Before the Dutch limited liability company is registered, a deed of incorporation and the articles of association must be drafted before a public notary. These documents will be in Dutch and will contain information about the shareholders, the management board, the registered address and the authorized share capital. The articles of association must also contain a brief description of the Dutch BV’s business activities.

The main steps to register a Dutch BV

Once the deed of incorporation and the articles of association have been drafted, one can start the registration procedure of the Dutch BV. The steps one must take are:

- reserve a company name,

- submit the deed of incorporation and the articles of association,

- obtain a registration number with the Commercial Register in the Netherlands,

- register with the tax authorities,

- register with the social security authorities.

Company registration in The Netherlands can also be done by signing a power of attorney and designating a representative like Tax & Service Solutions

Can I incorporate a BV without visiting Netherlands?

Yes. Foreign investors can incorporate a Dutch BV without a personal visit to the country by employing a company like Tax & Service SOlutions or individual to act in their behalf. This type of formation however does imply a slightly different procedure in which we are happy to inform you.

Can anyone set up a BV even if they are not located in The Netherlands?

Yes. Netherlands is very open to foreign investors. Anyone from any country can become a shareholder in a Dutch BV. To become a resident company however (to have local substance) the investors must comply with certain requirements.

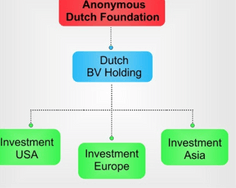

Can I set up an anonymous Dutch BV?

Certain Dutch structures can indeed maintain privacy. In this regard please see your options related to the creation of Dutch Foundation and nominee directors. Foreign investors can also choose to exercise ownership of their Dutch BV through an offshore company.

Why should I incorporate a Dutch BV?

A few of the main reasons why business people choose the BV entity in Netherlands are:

- Tax benefits: Netherlands is a very good option to legally minimize your tax burden when doing business in EU and in the world in general.

- Good local market: Netherlands is one of the most prosperous regions in the world offering a local market with very good potential.

- Excellent Transportation network: Netherlands has perhaps the most important ports and transporation hubs in Europe.

Am I able to open a Dutch Bank Account even if I am not a Dutch resident?

Yes, Tax & Service Solutions can assist you in opening a Dutch bank account and/or bank accounts in other countries worldwide.

I have also heard things about starting a foundation instead of a BV

Foundations fall under the regulations of the Civil Code and not the Dutch Commercial Code like any other usual company. Even if the resemblance with other types of Dutch companies is important, foundations or “stichting” have no members. They will also have a certain capital, but their main purpose is not to carry out business activities. Dutch foundations are allowed to make profits, but the use of such profits is subject to restrictions.

Even if their main purpose is a social one, foundations registered with the Dutch Companies Registrar are allowed to carry out regular commercial activities. Therefore, foundations are excellent structures suitable for tax minimization purposes, as they are considered Special Purpose Entities (SPEs). Among these are also Dutch holding companies. Both foundations and holding companies are usually associated with the avoidance of dividend and capital gains taxes, due to Netherlands’ double taxation agreements.

Setting up foundations in the Netherlands

Foundations are very easy to set up and do not require governmental approval, hence the name of non-governmental organizations or non-profit organizations. Foreign citizens wanting to set up foundations in the Netherlands are required to draft a deed of formation and the Articles of Association and notarize them. While the deed of formation represents the Memorandum and establishes the creation of the organization, the Articles of Association will determine the activities and the management of the Dutch stichting. An important aspect to keep in mind is that the Articles of Association must be in Dutch.

Dutch foundations as tax minimization vehicles

If registered for commercial purposes, foundations will be required to pay the corporate tax in the Netherlands. However, being a Special Purpose Enterprise, a foundation can also be established as an intermediate holding and thus provide investment protection to its settlors. Dutch Special Purpose Enterprises, therefore foundation, may also receive external funds and thus avoid being withheld the tax on interest payments. Dutch charitable foundations may also own corporate structures and thus benefit from a reduced corporate tax rate. Foundations associated with Dutch private limited companies may also benefit from exemptions from the corporate and dividend taxes.

Foreign investments are welcomed in the Netherlands and the Dutch legislation is very permissive with foreign companies. Netherlands’ foreign direct investments policy and tax benefits attract foreign investors. Domestic and foreign companies are treated equally under Dutch law.

Benefits for foreign investors

The laws for foreign direct investments are unbiased. Health, safety regulations and environmental rules apply to both local and foreign investors. Immigrants are allowed to live and work in the country.

The corporate income tax rate is 20% on the first € 200.000,- and 25% for taxable profits that exceed €200.000,-

The Netherlands have signed treaties with over 80 countries in order to avoid double taxation on income and capital. Withholding taxes on dividends, interest and royalties are thus reduced. In some cases, taxes are reduced to 0% for interest and royalties. Moreover, there are no withholding taxes on outgoing interest and royalty payments.

The Dutch tax law stipulates that the following are exempt from Dutch corporate income tax:

- cash dividends;

- dividends-in-kind;

- bonus shares;

- capital gains.

Investors can also benefit from the 30% ruling in The Netherlands

What about the costs?

Setting up a BV or Foundation will involve costs. For both constructions you will need a notary to set up the deed and terms and conditions. Besides the notary you will have to supply articles and regulations of you wish to start a foundation. These all have to be written in Dutch and therefore an expert is required to write these on you behalf.

A holding structure is more expensive then a single BV or foundation however the security which a holding structure provides has more benefits due to the fact that in the “lower BV” all the risks can be stalled.

The BV’s also have to make sure there that there will be an opening balance sheet due to tax obligations.

The total costs involved for opening a BV or Foundation are estimated on maximum € 1.450,- including all the extra costs like opening balance sheets, notary costs, power of attorney costs and chamber of commerce costs to register the BV.

The total costs involved for opening a holding structure are estimated on a maximum of € 2.750,- including all the costs mentioned above and taking into account that there will be a maximum of 3 new BV’s (including the holding)

Besides these costs there are also the yearly costs for the bookkeeping and tax declarations the yearly costs for a single BV or foundations. You can either choose one of our packages or apply for customized services.

Starting your own Dutch BV has never been easier!

Click here to find out how easy it is with Tax & Service Solutions!

Free Estimation

Request A Quote

We can help! Our clients love us because we’re friendly, enthusiastic, accommodating, and we listen to your needs. We’ll work with you to help you find the solutions you’ve been looking for! Feel free to Request a Quote at anytime.