TAX IN NL

THE DUTCH TAX IN GENERAL

The most common taxes in The Netherlands ordered for you;

All residents in The Netherlands are required to pay taxes if you earn money and/or have assets in The Netherlands.

The Belastingdienst ( Duth Tax Authorities) collects taxes through a variety of streams. Here are the main tax types that you will most likely encounter in the Netherlands:

Dutch Income tax (inkomstenbelasting)

If you are working in the Netherlands then you need to pay tax on your income. Even if you don’t have job you sometimes have to pay taxes (for example when you have assets in the Netherlands)

You must declare your income tax via your annual tax declaration form (aangifteformulier inkomstenbelasting) which can be done online or with the help of a Dutch tax advisor.

If you are employed by a company then your income tax will be withheld from your salary by your employer, this is known as wage tax (which is contained within payroll tax).

If you are self-employed in the Netherlands then you must calculate and pay your income tax via the annual tax return. However it is also common that the tax authorities send you a preliminary tax assessment based on your tax declaration in the previous year. In that case you will have to pay your taxes in advance every month.

Payroll tax (loonbelasting)

Payroll tax is tax and other contributions that are withheld from an employee’s salary by the employer, which saves the employee from having to pay them later as income tax. The payroll tax levy is made up of tax on your salary (wage tax or loonbelasting) and national insurance contributions for pensions, unemployment allowance and other state benefits.

Your payroll tax is deducted from your salary every month. It’s important for expats to keep the deduction in mind when discussing salary and contract terms for a new job. There is a large difference between your gross salary (brutto salaris) which includes tax, and your net salary (netto salaris), after tax is deducted. To calculate your net salary you can download the income calculator.

VAT sales tax (BTW / omzetbelasting)

The Belastingdienst also collects taxes via the sales or revenue tax (omzetbelasting), known in the Netherlands as BTW (Belasting over de Toegevoegde Waarde). All businesses, excluding some foundations and associations, must add BTW to the price of their goods and services.

There are three different levels of BTW: 0%, 6% and 21% (the most common rate).

Businesses (including freelancers) must calculate the BTW they have earned and spent via the quarterly sales tax declaration (BTW aangifte). They then pay this amount to the Belastingdienst.

A list of other kinds of taxes can be found at the end of this page.

Annual income tax declaration (aangifte inkomstenbelasting)

Even though wage tax has already been withheld from your gross salary as an advance levy or payment on your income tax, you often still need to complete an annual income tax return. The Dutch tax office will inform you if you are required to do so.

The tax declaration is necessary to balance out your “prepaid” tax with other financial aspects such as:

- your partner’s income

- a mortgage

- additional income, savings or investments

- tax deductions such as study or healthcare costs

Do I need to file a Dutch tax declaration?

Officially all residents of The Netherlands are obliged to file a yearly declaration.

The Dutch fiscal year runs from January 1 to December 31. In January or February you will receive a letter (aangiftebrief) from the Belastingdienst asking you to complete a tax declaration for the previous year.

If your financial affairs are simple and do not include any of the above elements then you may not receive a letter and you may not need to submit an annual tax return.

Please note that you can always apply for a free Tax San at Tax & Service Solutions.

You can always visit a Belastingdienst branch office or call the BelastingTelefoon on 0800 0543 to find out if you need to complete an income tax return and/or to request the letter.

What is the deadline for the Dutch tax return?

The time period for submitting your annual income tax return is from March 1 to April 30, unless you or your accountant request an extension (uitstel aangifte). You can do this via the BelastingTelefoon or the Belastingdienst website (you’ll need your DigiD). If you do not submit your tax return or request an extension before May 1 then you can be fined.

The Dutch Box system for taxes

Income on the Dutch tax return in the Netherlands is divided into three categories: Box 1, Box 2 or Box 3 (named after the tick boxes on the form).

Each box applies to different kinds of income and has a different tax rate. Here is an overview of the box categories and their different income sources:

Box 1: Income from salary

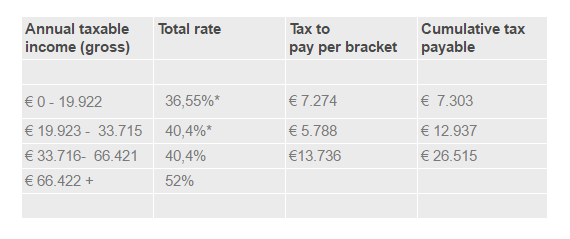

Income in Box 1 is taxed at different rates depending on how much you earn, with a progressive rate at a maximum of 52%. Check the table below to see the rate(s) that apply to your gross salary.

Box 1 tax rates for 2017

This table lists the income tax rates / brackets (tarieven) for people below retirement age:

* Includes 28,15% national insurance contribution

Box 1 dutch tax rate example for 2017

Here is a sample tax breakdown for an annual gross income of 30.000 euros:

- The first 19.922 euros will be taxed at 36,55%, so tax will be 7.303 euros.

- The remaining 10.078 euros will be taxed at 40,5% so tax will be 4.082 euros.

- Therefore you will pay a total of 11.384 euros tax (minus general and labour tax credits)

Box 1 income includes:

- Wages out of your job or employment

- Income out of your business

- Income as a freelancer, artist, childminder or professional athlete

- Gratuities such as tips

- Foreign income

- Income out of your own house such as rent and the notional rental value (eigenwoning forfait)

Box 1 deductions include:

- Deductible costs of home ownership

- Expenditure on income, such as premiums for annuities

- Alimony for your ex-partner and other maintenance obligations

- Specific medical expenses

- Temporary stay at a home for the severely disabled

- Tuition costs and other study expenses

- Maintenance of a heritage listed building

- Waived venture capital

Box 2: Income from interest in a limited company

Box 2 covers income from a substantial interest or holding (at least 5%) in a limited company such as a BV. In 2016 income in Box 2 is taxed at 25%.

Box 2 income includes:

- Regular benefits such as dividends

- Capital gains, such as gains on shares (after selling)

Box 3: Assets and savings

Box 3 covers income from assets such as savings and investments. The value of your assets, minus debts, is calculated once annually, on January 1, to determine your net capital value.

Everyone is entitled to an amount of tax-free capital/assets (heffingsvrij vermogen).

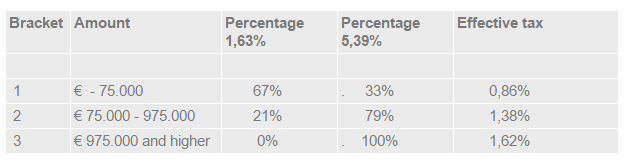

Tax-free capital/assets 2017 Box 3

In 2017 you can have assets with a value of up to 25.000 euros as an individual, and 50.000 euros as a couple, without them being taxed.

The Belastingdienst assumes you earn an income (benefit) of a fictive interest rate from the value of your assets. This income is taxed at 30%, which leads to an effective tax rate on your assets as mentioned in the table below.

Box 3 assets include:

- Stocks and shares

- Bank and savings accounts

- A second home or investment property

- Endowment insurance policy (if not connected to an owner-occupied residence)

Box 3 exemptions

Some assets are exempt from being taxed in Box 3, these include:

- The property you live in (if you’r the house owner)

- Moveable property such as furniture, art or a car (unless they are an investment)

- Certain kinds of life insurances

- Investments in forests, nature or certain green, social, ethical, cultural or startup projects

30% ruling

The 30% ruling is a tax advantage for certain expat employees in the Netherlands. The most significant benefit is that the taxable amount of your gross Dutch salary is reduced from 100% to 70%. So 30% of your wage is tax free.

Visit the 30% ruling page for more information.

Dutch taxes and non-residents

If you have income from another country, or you live outside the Netherlands and have a Dutch income, then you usually need to do the annual Dutch income tax return.

If you moved to or from the Netherlands during the course of the year then filing your tax return can be a wise move as you may be entitled to a substantial tax refund.

Fiscal partners in the Netherlands

The the authorities have a broad interpretation of who your fiscal partner (fiscaal partner) can be. Most commonly your tax partner is the person you are married to, have a registered partnership with, or simply live with in a relationship.

General and labour tax credits

Every taxpayer in the Netherlands is entitled to receive the general tax credit (algemene heffingskorting) and every working person is entitled to receive the labour tax credit (arbeidskorting or loonheffingskorting).

Both tax credits are calculated and credited to the tax balance on your salary by your employer, so it is not necessary to do anything to receive them. If you work for yourself then the tax credits are calculated when you complete your annual tax return.

The value of your tax credit depends on how much you earn, decreasing as your income increases. In 2016 the general tax credit starts at 400 euros for income under 10.000 euros and drops down to zero for income over 120.000 euros. In 2016 the maximum labour tax credit is 3.103 euros.

Other Dutch tax benefits

There are several kinds of tax allowances (toeslagen) available in the Netherlands for people on a low income. These include:

- Health care allowance (zorgtoeslag)

- Rent allowance (huurtoeslag)

- Unemployment allowance(WW uitkering)

- Child allowance (kinderbijslag) and child (day)care allowance (kindertoeslag)

Other forms of taxation in the Netherlands

There are many other forms of direct and indirect taxation in the Netherlands. These include:

Import tax (douane/customs)

A tax paid on goods received or imported from abroad. The amount depends on the value of the goods and if you receive them as an individual or for your business. If you, as an individual, receive goods worth more than 45 euros from abroad then you will need to pay minimum 2,5% import duties and BTW. The import tax also applies to internet purchases.

Motor vehicle tax (motorrijtuigbelasting)

This tax is paid when you buy or import a motor vehicle, or when a vehicle is put under your name. The amount depends on the type of vehicle (car, van, motorcycle, lorry etc.), weight and type of fuel. It falls under the environmental tax category.

Inheritance tax (erfbelasting)

A tax on wealth acquired by inheritance after someone dies, if their properties and financial affairs were in the Netherlands.

Gift tax (schenkbelasting)

A tax paid on the value of anything accepted as a gift from a resident in the Netherlands. There are exemptions for example if you give a gift to children (in case they buy a house in The Netherlands) or other relatives. Tax & Service Solutions are happy to inform you about all the possibilities

Corporate tax (vennootschapsbelasting)

Applies to companies that are established in the Netherlands and to those that receive income from the Netherlands but are not established here.

Transfer tax (overdrachtsbelasting)

The transfer tax must be paid by a buyer when purchasing a property or business. The most common form of transfer tax applies when a homebuyer purchases a house or apartment, for which the rate is currently 2% of the property value.

Gambling tax (kansspelbelasting)

A gambling tax of 29% must be paid on prizes worth more than 449 euros, won in any game of chance.

Insurance tax (assurantiebelasting)

On almost all insurances (except life insurances and healthcare insurances) you will pay a tax of 21%. This is quite similar to the VAT but with one big exception and that is that you can not deduct this tax with the VAT you paid to others when you run a business.

Dutch tax penalties

As of July 1, 2015, the Dutch tax office has increased the penalties for undeclared income. The penalty for voluntarily declaring hidden income, wealth or inheritance has risen from 30 to 60%.

Hidden income and or assets that is discovered by the Belastingdienst risks a fine of up to 300%.

Free Estimation

Request A Quote

We can help! Our clients love us because we’re friendly, enthusiastic, accommodating, and we listen to your needs. We’ll work with you to help you find the solutions you’ve been looking for! Feel free to Request a Quote at anytime.