The ‘luxury tax’ on sparkling drinks such as champagne, prosecco and cava expires on the 1st January 2017.

On average, a bottle will become 1.10 euros cheaper.

The special rate did not apply to cheaper bottles of prosecco with a screw cap. According to RTL, ten million bottles of sparkling beverages are sold annually. This tax change will cost the Dutch government approximately 10 million euros.

2012

A change to the special rate was already agreed on in 2012 in the budget agreement concluded by the VVD, CDA, D66, GroenLinks and the ChristenUnie.

Dutch residents paid far more tax for sparkling wine, because it was qualified as a more upscale product. The elaboration of the budget agreement stated that ‘following the emergence of cheaper sparkling products, this difference can no longer be justified’.

Excise duties

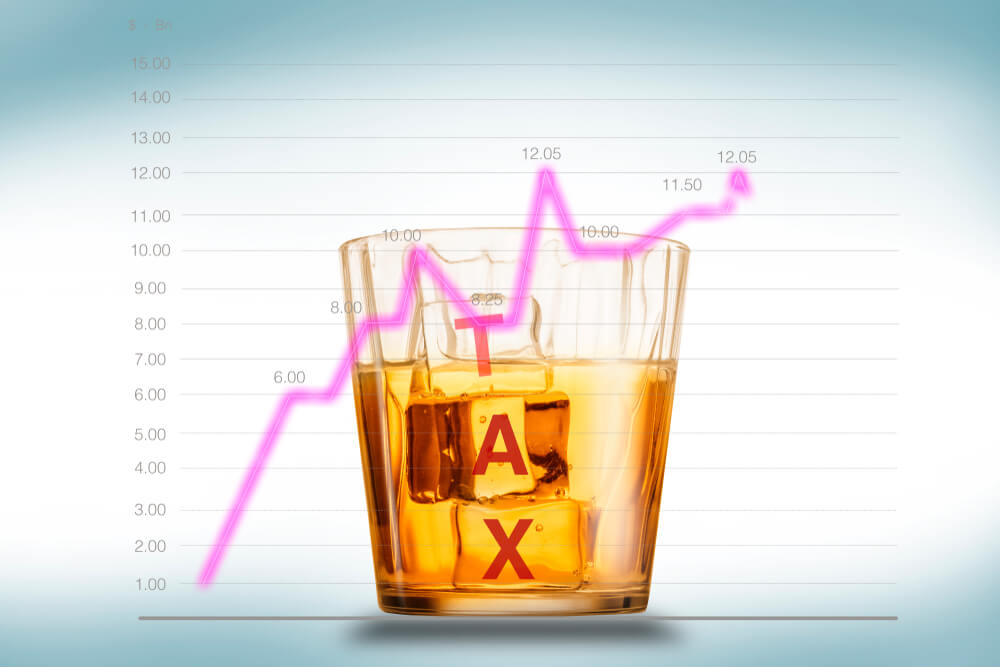

In recent years, excise duties on alcohol have soared in the Netherlands. In 2016, consumers had to pay nearly 10 percent more for alcoholic drinks than in February 2011.

Liquor stores

Of course we will have to wait and see whether the liquor stores and supermarkets will pass this benefit on to consumers, or whether they will take this opportunity to increase their profits…

Cheers!